Problem Definition

My W15 up to W19 Blog (5 blogs) are rejected by CfH and the first suggestion is to determine the MARR value instead of put the MARR value 20% from nowhere, so based on this condition I must do the analysis to calculate the MARR value and then continue to revise the W15 up to W19 Blogs.

Identify the Feasible Alternative

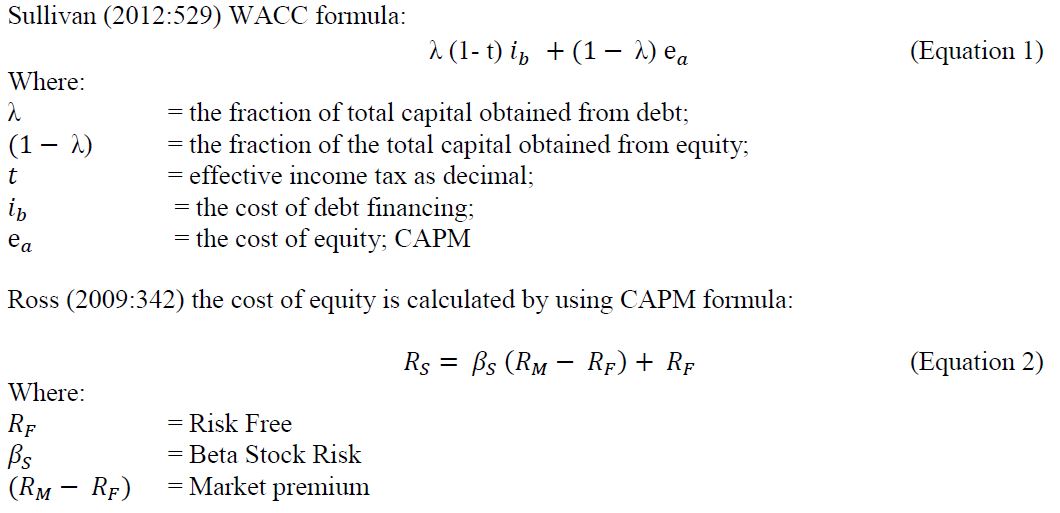

A hurdle rate, which is also known as minimum acceptable rate of return (MARR), is the minimum required rate of return or target rate that investors are expecting to receive on an investment. The rate is determined by assessing the cost of capital, risks involved and other factors that could directly affect an investment. If a company uses debt and equity to finance the project, company’s cost of capital is the Weighted Average Cost of Capital (WACC) which calculated portion of debt and portion of equity.

Development of the Outcome for Alternative

Application of WACC in Indonesia

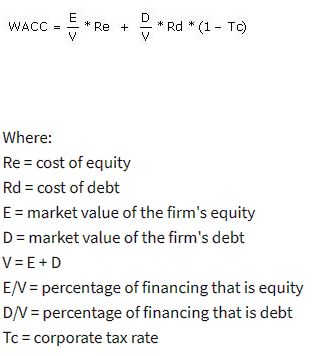

Based on the typical Industry that related with Geothermal Energy and with detail assumption on WACC components, the WACC calculation for each industry are as follows:

There is another formula that has the same meaning with equation 1 above:

Project Risk Category for Geothermal Industry Investment in Indonesia

- Project Risk by Activity

- Exploration Activity, and

- Development & Production Activity

- Project Risk by Location

- Sumatera

- Java

- Kalimantan, Sulawesi and Bali

- Nusa Tenggara (West & East), Maluku and Papua

Table 1. Geothermal Potency by Location

Analytical Hierarchy Process (AHP)

The AHP is a process for making a decision in an organized way to generate priorities. To make the comparison it is required a scale of number that indicates how many times more important or dominant one element is over another element which respect to the criterion with respect to which they are compared.

Table 2. The Fundamental Scale of Absolute Numbers (source: T.L. Saaty, 2008)

A pairwise comparison matrix for each criterion is the next result to be calculated until it finally obtained priorities for the sub criterion.

Selection Criteria

WACC Calculation

Table 3. WACC Calculation

The above calculation based on the following assumptions:

- Risk Free (Rf) is based on US Treasury Bond for 30 years (Retrieved May 10, 2018 at 9.00 PM EDT)

- Market Risk Premium (Rm) is based on 2012 Aswath Damodaran study on Equity Risk Premium (ERP) : Determinant, Estimation and Implications (with last update on January 2018).

- Beta (ß) is based on the information of beta industry from Aswath Damodaran study (for non-public listed company)

- Portion of debt and portion of equity based on each industry/ compnay financial statement with last updated on January 5, 2018.

By using the PERT Formula, the representative WACC can be calculated as follows:

- Average WACC = 7.57%

- Min – Max = 0.042

- (Min – Max)/6 = 0.007

- Z90% = 1.2817

- Sigma (σ) = 0.007

- Variance (σ2) = 0.00005

Representative WACC as PERT Formula = 7.57% + (1.2817)*0.007 = 8.48%

Application of MARR Calculation in Indonesia

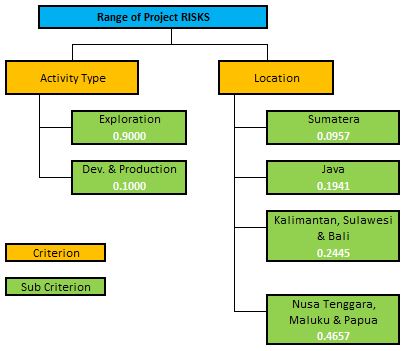

Figure 1. Range of Project Risk Hierarchical Tree

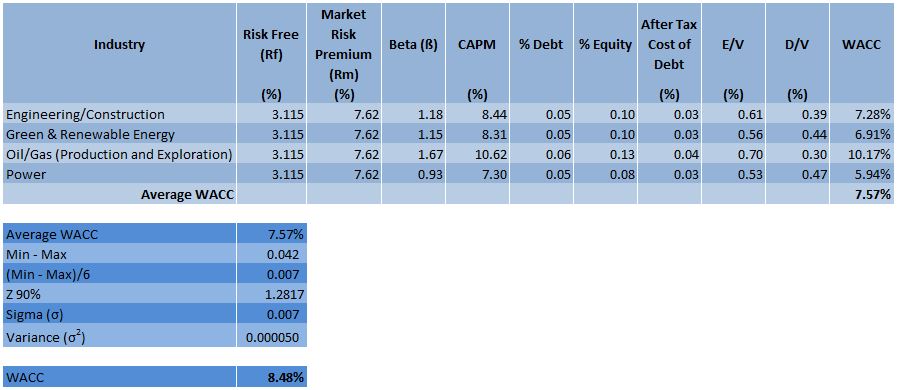

Table 4. Pairwise comparison matrix of Activity Criteria

Table 5. Pairwise comparison matrix of Location Criteria

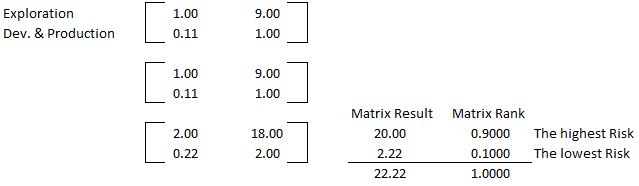

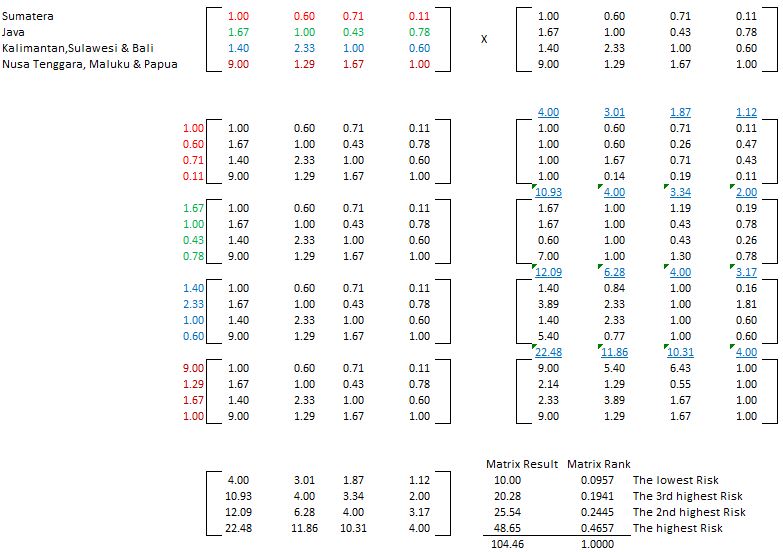

Matrix Algebra to calculate for each criterion ranking

Activities Type

Location

Analysis and Comparison of the Alternative

Figure 2. Hierarchical Tree with Matrix Ranking Result

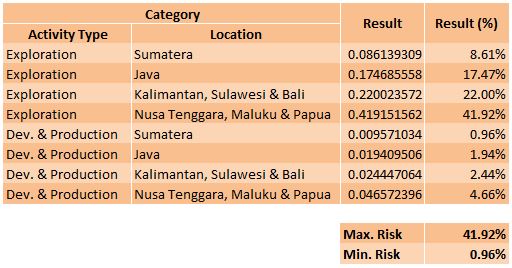

Table 6. Risk Scoring based on Risk Matrix Rank

Selection of the Preferred Alternative

The MARR for Geothermal Project in Indonesia can be calculated by adding that risk scoring of project risk and country risk with formula:

WACC + Risk Scoring + Country Risk

- The most risky project is the exploration in the Nusa Tenggara, Maluku and Papua locations with 41.92%.

The MARR should be 8.48% + 41.92% + 2.54% = 52.93%

- The least risky project is the Development and Production project in Sumatera location with 0.96%.

The MARR should be 8.48% + 0.96% + 2.54% = 11.97%

The appropriate range rate should be around 11.97% to 52.93% depend on the activity and location type that the project will be conducted in Indonesia.

Performance Monitoring and the Post Evaluation Result

The range rate result above should be identified by each company’s risk tolerance to adjust the MARR to be in line with the corporate strategy and risk analysis.

Another type of risk that need to be consider are:

- Land Acquisition (Forest Protected Area or Community Area)

- Number of Affected People, related with community issue and security issues

References:

- Sullivan, William G., Wicks, Elin M., Koeling, C. Patrick. Engineering Economy 16th Edition, Retrieved from: Chapter 5 Evaluating a Single Project and Chapter 13 The Capital Budgeting Process.

- PM World Journal (Featured Paper). Using Analytical Hierarchy Process to Determine Appropriate Minimum Attractive Rate of Return for Oil and Gas Projects in Indonesia (by Lita Liana), Retrieved from: https://pmworldjournal.net/article/using-analytical-hierarchy-process-determine-appropriate-minimum-attractive-rate-return-oil-gas-projects-indonesia/

- Hurdle Rate, Retrieved from: https://www.investopedia.com/terms/h/hurdlerate.asp

- Caution When Investigating Indonesia ETFs , Retrieved from: https://www.investopedia.com/news/caution-when-investigating-indonesia-etfs/

- Risk-Free Rate of Return, Retrieved from: https://www.investopedia.com/terms/r/risk-freerate.asp

- The Basics of The T-Bill, Retrieved from: https://www.investopedia.com/articles/investing/072513/basics-tbills.asp

- Effective Interest Rate, Retrieved from: https://en.wikipedia.org/wiki/Effective_interest_rate

- Hurdle Rate Definition, Retrieved from: https://corporatefinanceinstitute.com/resources/knowledge/finance/hurdle-rate-definition/

- WACC, Retrieved from: https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-wacc-formula/

- Capital Asset Pricing Model (CAPM), Retrieved from: https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-capm-formula/

- Market Risk Premium, Retrieved from: https://corporatefinanceinstitute.com/resources/knowledge/finance/market-risk-premium/

- World Resource Institute. 2 Things You Need to Know about Indonesia’s Forest Moratorium, Retrieved from: http://www.wri.org/blog/2014/01/2-things-you-need-know-about-indonesias-forest-moratorium

Very well done, Pak Fadlis. Congratulations!!!

See what a big difference actually calculating the MARR makes? Why is it NOT good to use 10% or 20%, but to use the MARR appropriate to the location and type of project!

Now it should only take you a couple of hours to catch up on your blogs, but this time instead of using 20%, you can use the % that most correctly reflects the RISKINESS.

BR,

Dr. PDG, Jakarta

LikeLiked by 2 people